ShmoopTube

Where Monty Python meets your 10th grade teacher.

Search Thousands of Shmoop Videos

Principles of Finance Videos 156 videos

Okay, so you want to be a company financial manager. It's basically up to you to make money for the shareholders. It would also be swell if you mad...

How is a company... born? Can it be performed via C-section? Is there a midwife present? Do its parents get in a fight over what to name it? In thi...

What is an income statement, and why do we need it in our lives? Well, let's take a look at an income statement for Year 1 of the Sauce Company, an...

Principles of Finance: Unit 3, Expenses - Variable v Fixed 17 Views

Share It!

Description:

Fixed expenses are fixed, while variable expenses... vary. Did we blow your mind with that one?

Transcript

- 00:00

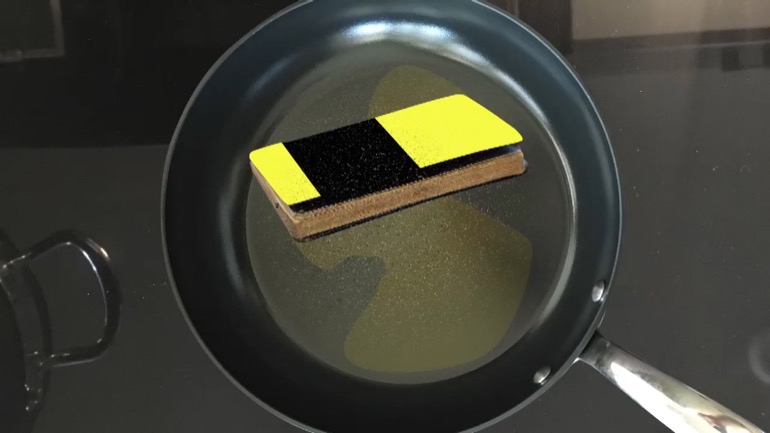

Principles of finance ah la shmoop expenses variable versus fixed

- 00:06

We'll once again let's go back to our little anemic

- 00:08

income statement for our lemonade stands are us thing with

- 00:12

a few adjustments made aren't sawn in twentynine bucky age

- 00:16

nineteen Credit card Sixteen thousand there All right Well this

Full Transcript

- 00:21

statement is seriously anemic It omits a ton of things

- 00:24

that in real life you have to pay for When

- 00:26

you run a really business like lawyer fees state unemployment

- 00:30

fees insurance legal things and on why'd we omit them

- 00:34

Kiss not the rock man Keep it simple Shmoop Ear's

- 00:37

All right So for now precision is our enemy Just

- 00:40

good wins All of that noted expenses break down into

- 00:43

two key categories as you run a business fixed things

- 00:47

like rent and insurance and that drinking cooler thing with

- 00:50

the huge plastic bubbles of water and variable like lemons

- 00:54

Hot month tons of traffic to the stores Well lots

- 00:56

of lemons snow months and on so many lemons It'll

- 00:59

very right Well when you build the sign ege for

- 01:02

your lemonade stand or the stand itself the counter behind

- 01:05

it the stools people sit on while they sip that's

- 01:07

All fixed or fixed in place In this case it's

- 01:10

a capital expense You'll pay for it once and then

- 01:14

use it for years Hopefully so here's a tricky one

- 01:17

for you If you spend a hundred bucks on a

- 01:19

stool how much did it cost Good one Well for

- 01:22

accounting nerds Uh here we go Answer a hundred books

- 01:26

Answer be before or after tax extra points for that

- 01:30

one Well can you expense the full hundred dollars Assumes

- 01:33

you've committed to pay for it Should you Well if

- 01:36

the stool will last five years and then be worth

- 01:39

zero at the end of those five years wealth and

- 01:41

isn't it really a twenty dollars a year kind of

- 01:44

expense Even though you had to pay one hundred dollars

- 01:46

in cash for it up front Well what if the

- 01:48

stool is worth twenty dollars after five years when you

- 01:52

sell it used on ebay That is it's Residual value

- 01:56

is twenty bucks It will have lost eighty dollars in

- 01:59

value during those five years not one hundred So what

- 02:02

do you do Well you don't appreciate the whole hundred

- 02:04

dollars in value of the stool as if it was

- 02:07

Kindle ing at the end you just appreciate eighty dollars

- 02:10

of it or sixteen dollars a year for five years

- 02:13

while lots of other ways to think about expensing this

- 02:16

expense and its relative value to the firm meaning that

- 02:19

one way to look at assessing the cost of that

- 02:22

stool sorry different stool Like what if a stool could

- 02:26

last forty years or two years but that its duration

- 02:30

was entirely dependent on the number of butts that sat

- 02:34

on it All right In that case we turn to

- 02:36

answer See prue would per glass per week per customer

- 02:39

per But well there we go That's the winner let's

- 02:42

say you pay one hundred dollars for that stool And

- 02:44

in its lifetime it only sat butts from one hundred

- 02:47

paying customers in that entire five years before then wore

- 02:50

out Well then the cost of that seat per but

- 02:53

was a buck that's a dollar but a buck a

- 02:55

butt and each but or its owner paid a dollar

- 02:58

for eliminates So that hundred dollars was a lot to

- 03:01

pay for that stool based on the butts it served

- 03:04

Why was the stool too fancy No it was expensive

- 03:08

On a relative basis because you had so few customers

- 03:12

using it if you'd had like ten thousand customer but

- 03:15

sit on that stool over the course of five years

- 03:17

well and per customer but it cost one hundred dollars

- 03:20

divided by ten thousand or a penny a customer but

- 03:23

and if on average each customer bought who drinks well

- 03:26

it be half a penny a cup and that's ah

- 03:29

point five percent in stool costs per cup cheap The

- 03:32

big takeaway here however is that the stool cost is

- 03:36

fixed it a ton of people use it assuming no

- 03:38

breakage or only a few people use it well that

- 03:41

hundred dollars you spent toe by it was fixed or

- 03:44

set no very ability So all the stuff we were

- 03:47

talking about above was fixed and remember fixed things are

- 03:51

things like capital expenses like the stool which has kind

- 03:53

of a set depreciation schedule and things like rent and

- 03:56

insurance which generally don't change from month to month question

- 04:00

is insurance variable or fix has an expense Well it's

- 04:05

fixed Usually you don't change it every month you buy

- 04:07

insurance based on a number of factors but once you

- 04:10

buy it You kind of have a set premium and

- 04:12

that's it You pay it month after month as the

- 04:14

insurance company smiles and winks at you but it rikers

- 04:18

as a charge month after month It is fixed but

- 04:21

recurring you know like the costs of leasing a building

- 04:25

All right so moving on next category variable costs cups

- 04:29

and lemons the lemonade itself there variable amounts mostly but

- 04:33

you don't buy Cops wanted a time Here's another curveball

- 04:36

for you You buy them in boxes of a thousand

- 04:38

saved money via volume discounts You get it You're a

- 04:40

friendly people at costco Yeah we love costco So cups

- 04:44

expenses air variable but at a unit rate of a

- 04:46

thousand cups at a time So if the cups cost

- 04:49

us dime than the unit variable is one hundred dollars

- 04:53

box of a thousand cups Generally speaking the product you

- 04:56

serve because it's volumes generally very is almost always a

- 05:01

variable cost Okay here's curveball question our employees of variable

- 05:05

or a fixed cost Well the answer both or at

- 05:09

least some employees operate that way Think about a sales

- 05:12

rep selling gigabit secure routers to banks with a friendly

- 05:16

smile and a tie She gets a modest base salary

- 05:19

maybe two grand a month and then she gets ten

- 05:22

percent of whatever she sells If she has a big

- 05:24

year and sells three million dollars worth of routers well

- 05:27

then wow three hundred grand in commission for that year's

- 05:30

work is her variable cost that twenty four grand a

- 05:34

year of base salary was fixed All right what about

- 05:36

taxes Are they variable Yeah it's very variable They change

- 05:40

every year based on how profitable or not you are

- 05:44

in that year Alright well at the end of this

- 05:45

story you have profits hopefully and it's the job of

- 05:48

companies to produce profits That's Why shareholders invested a dollar

- 05:53

in order to get mohr than a dollar back when

- 05:55

the company was started Of all the income statement line

- 05:58

items profits or the squishy ist or most squishy is

- 06:01

that what you think Well they can be cajoled manipulated

- 06:04

faked stretch shrunk adam braided in uh tweaked in nineteen

- 06:08

thousand ways So whenever you hear profits number be skeptical 00:06:13.087 --> [endTime] and a half

Related Videos

GED Social Studies 1.1 Civics and Government

What is bankruptcy? Deadbeats who can't pay their bills declare bankruptcy. Either they borrowed too much money, or the business fell apart. They t...

What's a dividend? At will, the board of directors can pay a dividend on common stock. Usually, that payout is some percentage less than 100 of ear...

How are risk and reward related? Take more risk, expect more reward. A lottery ticket might be worth a billion dollars, but if the odds are one in...